Cboe Global Indices strategy indices are used by investors to explore various strategies - like income generation.

Indices designed for income generation track the hypothetical performance of selling options compared to traditional investments.

BuyWrite strategies and PutWrite strategies often have experienced less volatility, lower Betas, and less severe drawdowns than related stock indices.

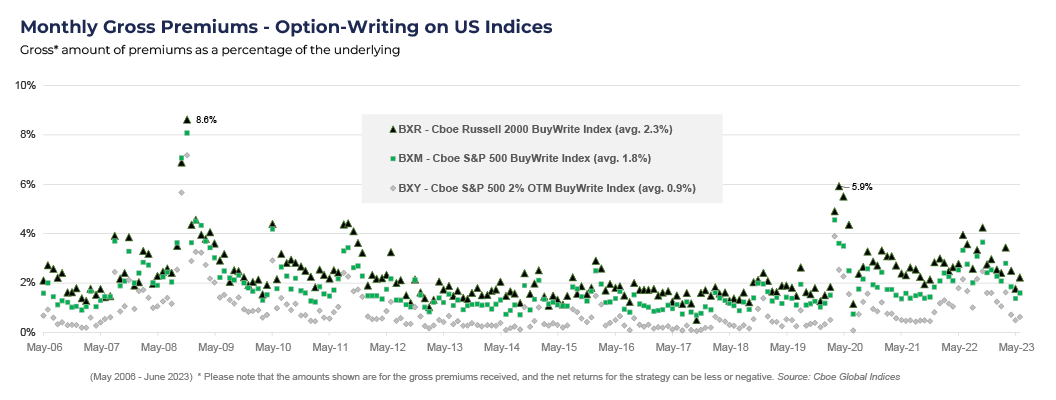

The chart below shows the gross amount of yield as a percentage of the underlying values held for the BXR, BXM and BXY Indices.

The BXR Index had the highest yield because the Russell 2000 Index was more volatile than the S&P 500 Index, and the BXR and BXM indices that wrote at-the-money index options generated more gross premium than the BXY Index that wrote out-of-the-money S&P 500 options.

Aon Hewitt

Download WhitepaperThere are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained here. These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle.