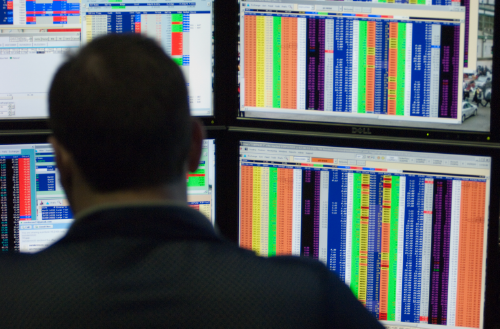

Cboe’s Pan-European Solution for Enhancing Retail Executions

As Europe’s largest stock exchange by value traded, Cboe Europe is leveraging its pan-European coverage, extensive market relationships and commitment to innovation to deliver better execution outcomes for retail investors. Alex Dalley, Head of European Cash Equities, explores our new European Best Bid and Offer (EBBO) retail service, its points of differentiation and the regulatory tailwinds behind the initiative.