Global Markets

Tradable Products

Cboe Data Vantage

Analytics & Execution

Access Solutions

Indices

Other Solutions

Life is Better with Options.®

Your investments could be too.

Discover more options for your portfolio.

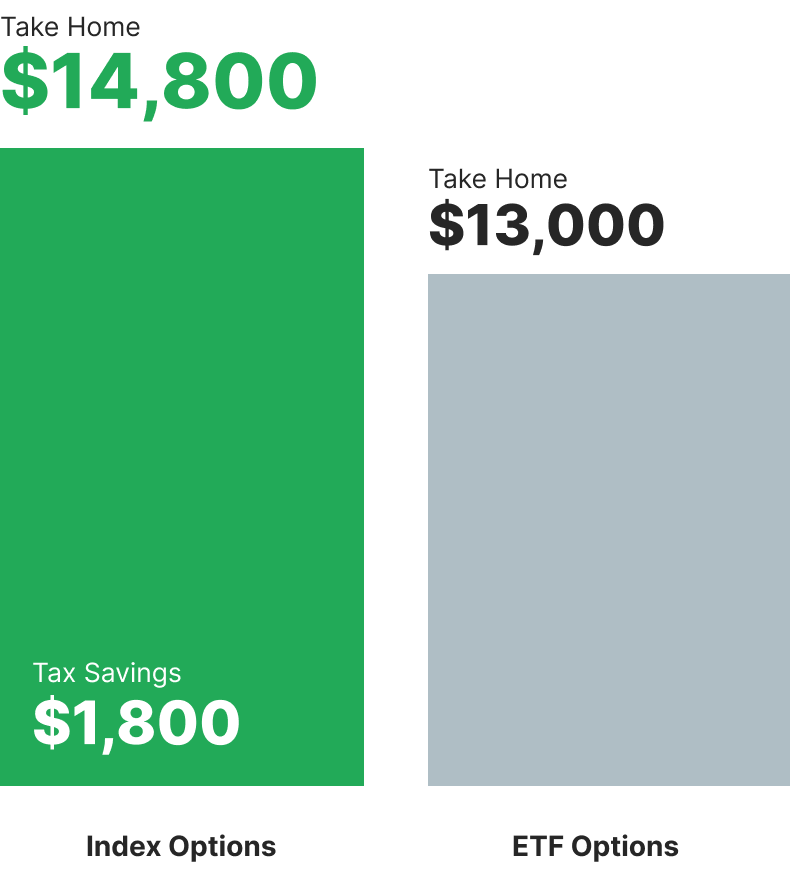

More profit or more taxes?

Some choices are easy to make. Cboe Index Options may qualify for certain tax advantages that keep more profit in your pocket.

Index options are flexible products that expand your trading toolbelt and can help unlock more opportunities to empower your investing strategies. So let’s take a look at how the benefits of index options could make them a better option for you.

Use the dropdown to see how much you could potentially take home with Cboe Index Options vs. ETF Options.

$20,000

Assumes that the investors in the index option and the ETF option are both in the 35% tax bracket and filing jointly, with a long-term capital gains tax rate of 20%.

Large. Medium. Small.

The powerful benefits of Cboe Index Options

Index options are flexible products that expand your trading toolbelt and can help unlock more opportunities to empower your investing strategies. So let’s take a look at how the benefits of index options could make them a better option for you.

Cash money? Yep. That’s an option.

Index options are settled in cash at expiration. That means your trade’s profits and losses are settled as a debit or credit directly into your trading account. So now you don’t have to worry about receiving or delivering shares upon exercise or assignment.

Cash Settled

NOT Cash Settled

Subscription Center

I'm interested in updates about:

Get started with index options and find a local broker.

Index options are settled in cash at expiration. That means your trade’s profits and losses are settled as a debit or credit directly into your trading account. So now you don’t have to worry about receiving or delivering shares upon exercise or assignment.

In order to assist market participants that would like to engage in transactions in Cboe index options and futures products, Cboe provides a list of brokers that have indicated to Cboe that they offer brokerage services in one or more of the Cboe products referenced on the Find a Local Broker webpage and that have requested to be included on this list. The brokers listed on the Find a Local Broker webpage that provide brokerage services in one or more of these Cboe index options products are also referenced above.

This list is provided solely for informational purposes and not as an endorsement of any particular broker. No significance should be attached to a broker's inclusion or omission. The list may not be exhaustive since the list only includes those brokers that have requested to be included on the list. In connection with compiling this list, Cboe has not investigated the background or disciplinary history of any of the brokers listed or whether or not they have any required registration status.

If a specific broker is not listed below, please contact the broker regarding product availability. Customers should use care in choosing a broker and consider factors like those identified on the SEC website and CFTC website in deciding which broker to use.

Any broker that would like to be included on this list or have its listing revised or removed should complete the Broker Website Consent Form.

Ready for more options?

If you want to take a deeper dive into the ins and outs of Cboe Index Options, we have a great resource for you. Our comprehensive guide gives you more details about the world of options available to you with these products.

* Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options, including SPX Options, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code. Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/global-disclaimers/.