Now Trading

The Next Generation of Volatility Products

The VIX Complex Leading Up to the Election

Trading VIX Options

Monthly and weekly expirations in VIX options are available and trade during U.S. regular trading hours and during a limited global trading hours session (8:15pm ET - 9:25am ET). Additionally, the VIX Index is calculated and disseminated overnight, providing market participants with real-time volatility information whenever news breaks.

Trading Resources

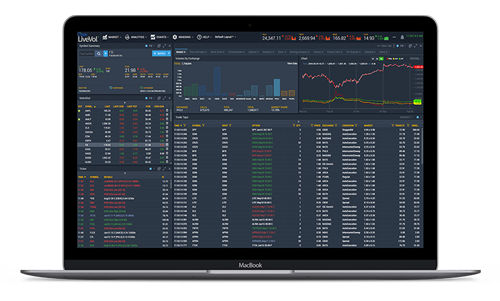

VIX Options Analytics

Get analysis on VIX Options and the rest of the U.S.-listed options market with Cboe LiveVol analytics platforms. LiveVol’s web-based platforms provide everything you need to quickly analyze trading activity and identify opportunities.

View tutorials and take a free trial at LiveVol.com.

Settlement of VIX Derivatives

The VIX Index settlement process is patterned after the process used to settle A.M.-settled S&P 500 Index options. The final settlement value for Volatility Derivatives is determined on the morning of their expiration date (usually a Wednesday) through a Special Opening Quotation ("SOQ") of the VIX Index. By providing market participants with a mechanism to buy and sell SPX options at the prices that are used to calculate the final settlement value for Volatility Derivatives, the VIX Index settlement process is "tradable."

VIX News

Derivatives Market Intelligence

Subscribe to the Derivatives Market Intelligence SeriesVolatility 411 Daily Video

Select VIX Institutional Research

The Cboe Volatility Index® (VIX® Index) is considered by many to be the world's premier barometer of equity market volatility. The VIX Index is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors' consensus view of future (30-day) expected stock market volatility. The VIX Index is often referred to as the market's "fear gauge".

The VIX Index and Volatility-Based Global Indexes and Trading Instruments

CFA Institute Research Foundation

A Case Study of Portfolio Diversification During the 2008 Financial Crises

University of Massachusetts

The inclusion of research not conducted or explicitly endorsed by Cboe should not be construed as an endorsement or indication of the value of any research.