PPUT Index

PPUT Index Dashboard, PPUT Dashboard

Index Dashboard

- PPUT

Cboe S&P 500 5% Put Protection Index

- Overview

- Performance

Cboe S&P 500 5% Put Protection Index (PPUT)

The Cboe S&P 500 5% Put Protection IndexSM (PPUT) tracks the value of a hypothetical portfolio of securities (PPUT portfolio) designed to protect an investor from negative S&P 500 returns. The PPUT portfolio is composed of S&P 500® stocks and of a long position in a one-month 5% out-of-the-money put option on the S&P 500 (SPX put).

The PPUT portfolio is rebalanced monthly, typically on the third Friday of the month, when the SPX put expires. A new SPX put is then bought.

Resources

Protective Put Strategy

Goal

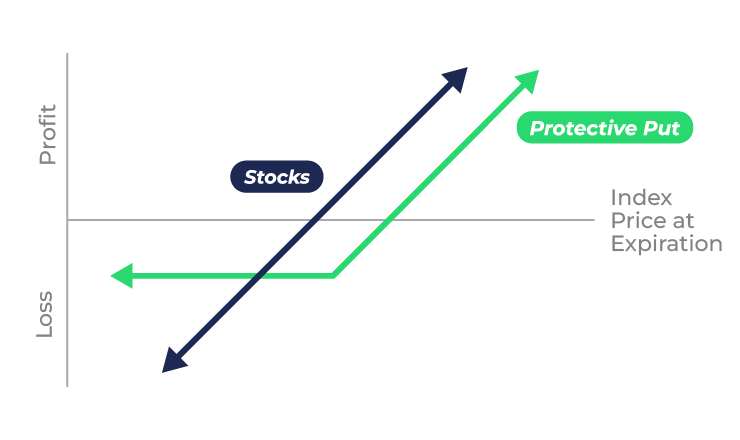

A goal for the purchase of cash-settled stock index protective put options often is to hedge a price drop in the stock index.

Strategy

A stock index protective put position can be created by (1) owning or buying a portfolio of stocks, and (2) buying corresponding stock index put options to hedge some of the downside risk of the stock portfolio.

Comments

The stock index protective put is designed to limit downside risk and establish a floor price, with the upside being potentially unlimited, after factoring in the premium and commission costs. To mitigate the net upfront costs for options premiums, the features of the protective put could be compared with the collar strategy.