PPUT3M Index

PPUT3M Index Dashboard, PPUT3M Dashboard

Index Dashboard

- PPUT3M

Cboe S&P 500 Tail Risk Index

- Overview

- Performance

The Cboe S&P 500 Tail Risk Index (PPUT3M) is a benchmark index designed to track the performance of a hypothetical risk-management strategy that consists of (a) holding the S&P 500 portfolio and collecting dividends and (b) buying 10% out-of-the-money SPX puts that expire on the quarterly cycle, i.e. March, June, September and December.

Resources

- PPUT3M Methodology

- Click here to see the complete roll data.

Cboe PPUT3M Index Roll Information - March 21, 2025

| Index | Name | Reference Price | New Option Strike Price | New Option VWAP Price | Underlying Index VWAP |

|---|---|---|---|---|---|

| PPUT3M | Cboe S&P 500 Tail Risk Index | 5643.67 | 5075 | 49.7 | 5636.355 |

Cboe PPUT3M Index Roll Information - December 20, 2024

| Index | Name | Reference Price | New Option Strike Price | New Option VWAP Price | Underlying Index VWAP |

|---|---|---|---|---|---|

| PPUT3M | Cboe S&P 500 Tail Risk Index | 5947.11 | 5320 | 44.65 | 5958.9025 |

Cboe PPUT3M Index Roll Information - September 20, 2024

| Index | Name | Reference Price | New Option Strike Price | New Option VWAP Price | Underlying Index VWAP |

|---|---|---|---|---|---|

| PPUT3M | Cboe S&P 500 Tail Risk Index | 5704.44 | 5120 | 40.4 | 5695.1575 |

Protective Put Strategy

Goal

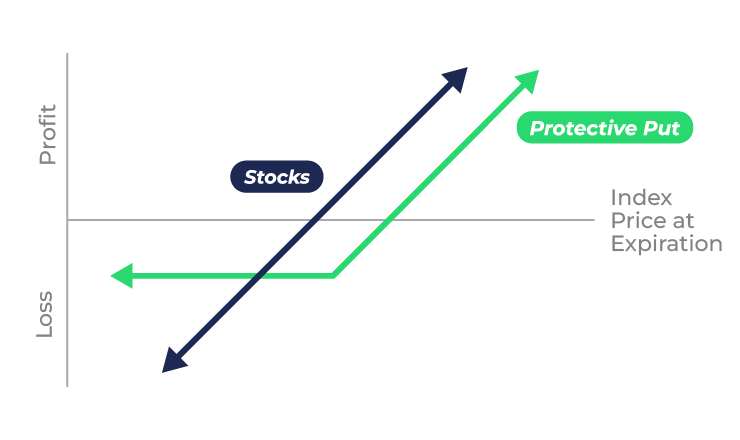

A goal for the purchase of cash-settled stock index protective put options often is to hedge a price drop in the stock index.

Strategy

A stock index protective put position can be created by (1) owning or buying a portfolio of stocks, and (2) buying corresponding stock index put options to hedge some of the downside risk of the stock portfolio.

Comments

The stock index protective put is designed to limit downside risk and establish a floor price, with the upside being potentially unlimited, after factoring in the premium and commission costs. To mitigate the net upfront costs for options premiums, the features of the protective put could be compared with the collar strategy.