VXTH Index

VXTH Index Dashboard, VXTH Dashboard

Index Dashboard

Return to All Indices

Add an Index...

- VXTH

Cboe VIX Tail Hedge Index

Last Sale:

543.31

Change:

-10.41 (-1.92%)

High:

552.83

Open:

552.83

Low:

542.40

Prev Close:

543.31

Last Updated:

2025-04-04 T: 16:15:00

Zoom:

- Overview

- Performance

The Cboe VIX Tail Hedge IndexSM (VXTHSM) tracks the performance of a hypothetical portfolio that -

- Buys and holds the performance of the S&P 500® index (the total return index, with dividends reinvested), and

- Buys one-month 30-delta call options on the Cboe Volatility Index® (VIX)® . New VIX calls are purchased monthly, a procedure known as the "roll." The weight of the VIX calls in the portfolio varies at each roll and depends on the forward value of VIX, an indicator for the perceived probability of a "swan event".

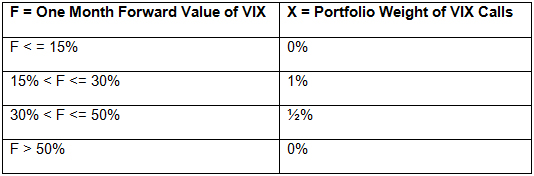

- The weights are determined according to the schedule below and the weights applied at a particular roll date can be seen by opening the VXTH Monthly Roll Spreadsheet (see links below).

The power of the VXTH index comes from the exceptionally high returns garnered by VIX calls in times of steep stock market declines. This means few VIX calls need to be purchased. To further increase efficiency, the VXTH is carefully calibrated: the weight of the VIX calls in the portfolio varies at each roll depending on the likelihood that a "black swan" event is about to occur. This has the effect of reducing hedging costs and monetizing VIX option profits when extreme volatility levels are reached. This monetizing of the VIX option position in turn means that overall capital can be preserved.