Read More

What’s New at Cboe: Launches, Transfers

A year of innovation. A year of change. For many reasons, 2020 will be one for the history books.

As of the end of October, 237 ETFs had launched, outpacing last year’s record by more than 30 funds. Of these, 84 launches — or 35% — have Cboe as their primary listings exchange.

We also welcomed several transfers this year, including the full O’Shares family of ETFs, together worth $1.2 billion; Virtus’s updated, rebranded Virtus WMC International Dividend ETF (VWID); and the Opus Small Cap Value ETF (OSCV), which brings Aptus Capital Management’s entire $869 million product suite under one roof.

Today, Cboe proudly lists more than 400 ETFs, spanning every size, style, sector, factor, region and strategy. Together with our issuer partners, we’re continuing to break new ground and define what the next generation of ETFs can be.

Sustainable Investing Goes Mainstream

In 2020, investors flocked to environmental, social and governance (ESG) ETFs like never before, pouring $27 billion into the segment — more than doubling its total assets invested.

The 33 Cboe-listed ESG ETFs gained significant traction with investors, as well. For example, Vanguard has already attracted roughly $1.6 billion into its total market equity ETFs, while Nuveen brought in just over $900 million across its size and factor-based equity funds.

As ESG captured investor mindshare and market share, our issuer partners also were making waves:

Learn More About How to List ETFs On Cboe.

Sometimes, magic happens in this business. The right ETF meets the right moment in time, and an investment paradigm shifts, almost overnight.

In 2020, defined outcome ETFs shifted that paradigm. In a year fraught with uncertainty, investors began to demand better ways to manage risk. Defined outcome ETFs offered a clear, sensible solution, allowing investors to easily and conveniently establish a set range of acceptable outcomes for their investments.

With 72 products listed, Cboe has emerged as the leading venue for defined outcome ETFs, with more than 95% of the total assets invested in these ETFs listed on our exchange.

We’re proud to count among our partners all the thought leaders in this space, including Innovator Capital Management, First Trust/Cboe Vest and TrueMark Investments — with more products and partners soon to be announced. Stay tuned!

Source: Cboe Global Markets. Data as of Nov. 2, 2020

Source: Cboe Global Markets. Data as of Nov. 2, 2020

Request More Information About Listing Your ETF On Cboe.

After years of anticipation, semi-transparent active ETFs finally made their debut this spring — at Cboe.

In fact, our reputation for enabling innovation is why we’ve emerged as the listing venue of choice for this first-of-its-kind class of funds, with products from American Century, ClearBridge and Fidelity all calling Cboe home. Coming soon: more products from more issuers, including J.P. Morgan, and Invesco.

Investors have flocked to our partners’ products: Two out of every three dollars invested in semi-transparent active ETFs are invested in a Cboe-listed fund.

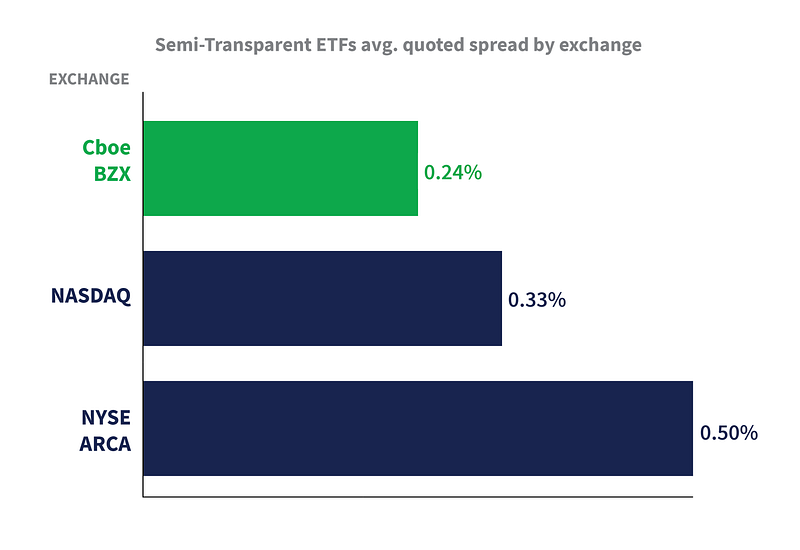

It’s easy to see why: Cboe offers the best-in-class market quality and liquidity in the space. For example…

Spreads on Cboe are less than half those on NYSE Arca.

Source: Cboe Internal Data. Calculated using a time weighted average over August — October 2020

Source: Cboe Internal Data. Calculated using a time weighted average over August — October 2020

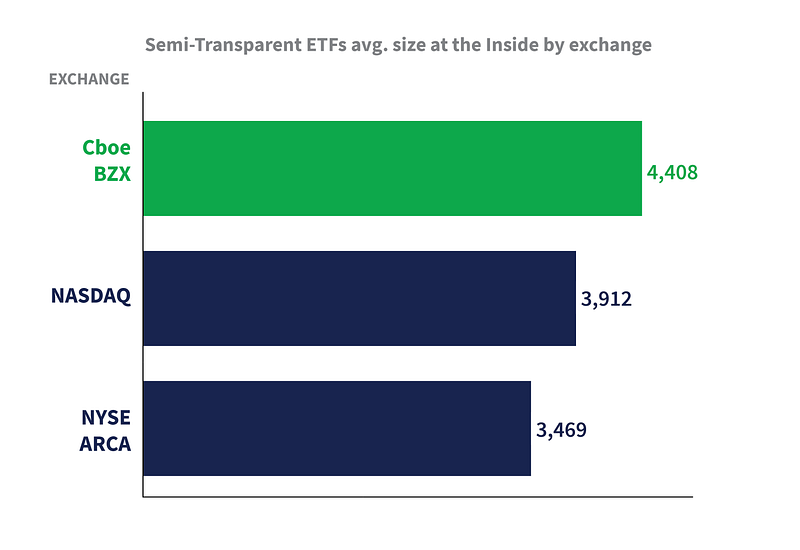

On average, investors can trade more shares at National Best Bid/Offer pricing…

Source: Cboe Internal Data. Calculated using a time weighted average over August — October 2020

Source: Cboe Internal Data. Calculated using a time weighted average over August — October 2020

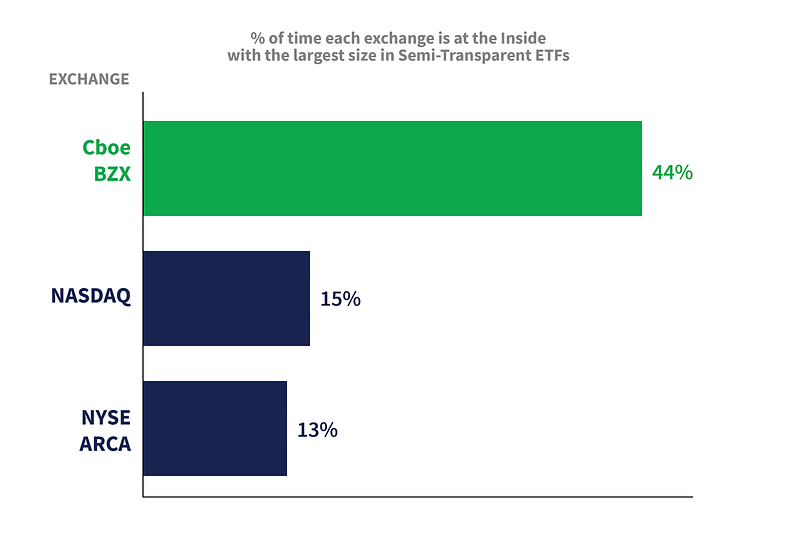

…While also being more likely to find NBBO prices, even for their largest block trades.

Source: Cboe Internal Data. Calculated using a time weighted average over August — October 2020

Source: Cboe Internal Data. Calculated using a time weighted average over August — October 2020

Making better markets, one bold new idea at a time. At Cboe, that’s what we do best.

Learn More About Enhanced Market Quality on Cboe.

Late last year, the SEC approved the “ETF Rule,” a set of regulations designed to speed up and streamline the process of launching new ETFs. This new rule allowed us to do some streamlining of our own.

Recently, Cboe received the SEC’s stamp of approval on several updates to our generic listing standards, which apply to any fund relying on the ETF Rule, including:

These new listing standards significantly reduce the regulatory burden on issuers, particularly boutique firms and new market entrants. They also eliminate the need for exchange rule filings for most ETFs, which reduces regulatory uncertainty and time to market. In short, the new rules significantly reduce the differences between exchange listing rules and other ’40 Act requirements, making the process for listing much more straight-forward.

By trimming these redundancies, we’re leveling the playing field, reducing time and cost to market for all ETF issuers, regardless of size.

The December 23 deadline for ETF Rule compliance is fast approaching. If you haven’t already, please contact listings@cboe.com for more information about converting to the new rulesets.

Learn More About How to List ETFs On Cboe

Your ETFs aren’t cookie-cutter. So why should your listing exchange be? Cboe offers its ETF partners:

To learn more about listing or transferring your ETFs to Cboe, contact one of our listings experts today at listings@cboe.com.