(test 3) VIX® Option Volumes Jumps to Highest Since Feb18

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

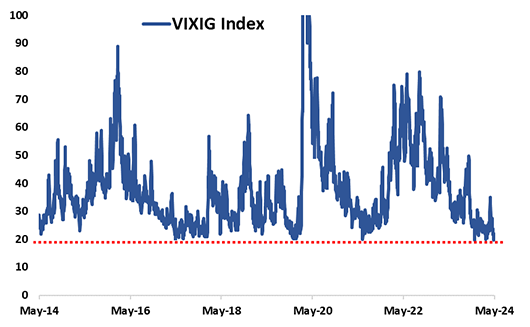

- Implied volatilities increased sharply across asset classes last week as US yields surged on the back of higher CPI inflation while Middle East tensions escalated. Gold 1M ATM vol jumped to a 1-year high. Within equity vol, VIX volatility saw the biggest jump as the VVIX index surged over 13 pts to 103% on the back of near record-setting VIX options activity. VIX option volumes hit a 6-year high, exceeding the highs we saw in Mar23 (SVB crisis) and Mar20 (covid). See chart below.

- SPX® skew has seen a meaningful steepening over the past two weeks on the back of both higher downside put demand as well as lower right-tail risk being priced into the vol surface. SPX 1M skew (25-delta spread), for example, has more than doubled from a low 1.5% in March to now 4.2% (74th percentile high over the past year).

Source: Cboe

[Download Full Report Here]

[Subscribe Here]