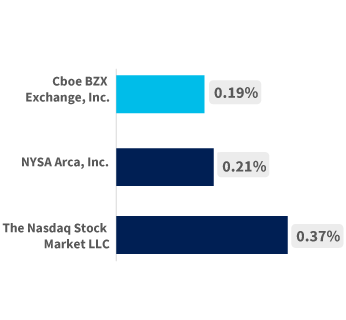

Primary Listings Average National Best Bid & Offer Spreads

Volume Market Share by Exchange Group

Cboe Internal Data over January 2022.

Though similar to a standard ETF in terms of affordability, tax advantages and liquidity, Semi-Transparent ETFs are only required to disclose holdings quarterly, like mutual funds. This disclosure method enables asset managers to take advantage of the liquidity and tax-advantage benefits of the ETF structure, while keeping their proprietary strategy hidden to protect shareholders.

*The above chart briefly exemplifies some of the advantages of the Semi-Transparent ETFs. It is not intended to be a full explanation.

As issuers' products mature and increase in volume, issuers' listing fees decrease.

(shares/day)

$5,000

(shares/day)

$5,500

(shares/day)

$6,000

(shares/day)

$7,000

Issuers that transfer to Cboe will pay a flat annual listing fee.

Products that require a 19b-4 filing will be charged a one-time fee of $7,500 per product. If products do not require a 19b-4 filing, then the Annual Listing Fees are the only applicable fees.

Annual Listing Fees for series of ETPs that are designed to provide a particular set of returns over a specified outcome period based on the performance of an underlying instrument during the ETP's outcome period will be capped at $16,000 per year.

Holistic support for your products long past launch from Cboe's legal, marketing and listing specialists, all with decades of ETP-specific expertise.

Growth in Semi-Transparent ETFs over the years

How markets are made with Semi-Transparent ETFs

A new era of investing